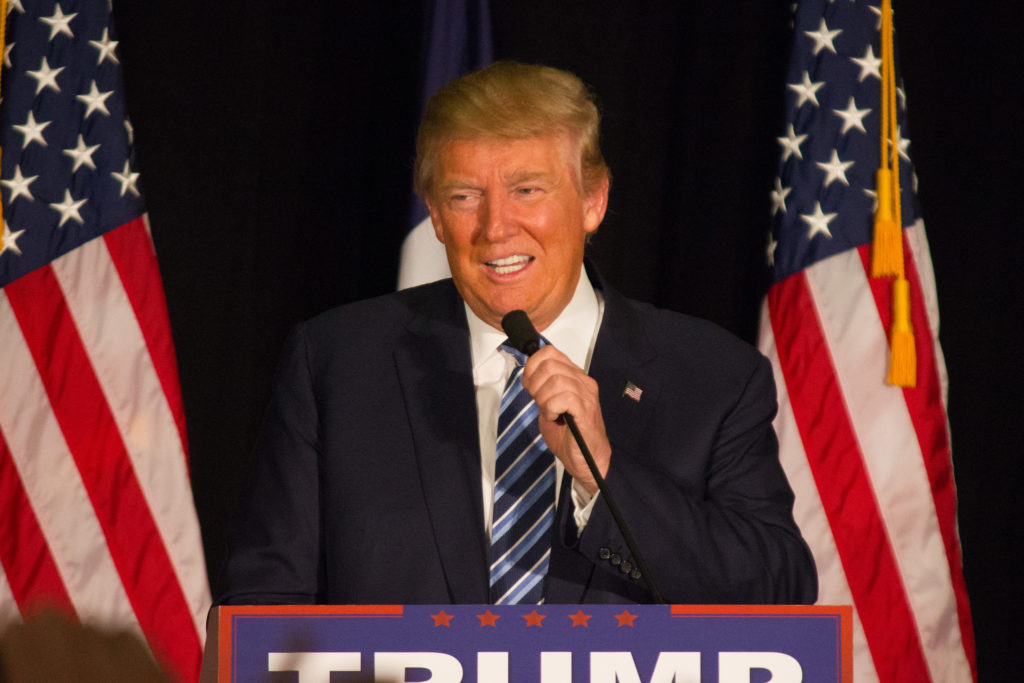

While the motives behind it are unclear, United States President Donald Trump’s decision to claim Florida as his place of residence could put him in line for a tax exemption it shares with a few other states.

The president announced at the end of October 2019 that he would relocate to his resort in Palm Beach, Florida. “I cherish New York, and the people of New York and always will,” he wrote on his Twitter account, adding falsely:

I have been treated very badly by the political leaders of both the city and state. Few have been treated worse.

The announcement came less than a month after officials in Palm Beach County recorded the “declaration of domicile” documentation filled out by both Trump and his wife, Melania Trump. The president claimed, without proof once again, that he paid “millions of dollars in city, state and local taxes each year” while living in New York. His tax returns — which have yet to be released as of November 2019 — are the subject of a subpoena from Manhattan District Attorney Cyrus Vance Jr.

Trump responded by filing a federal lawsuit against Vance, claiming that it is unconstitutional for the records to be subpoenaed before he leaves office.

The news of the president’s abrupt move was accompanied on Twitter by a thread that was shared more than 6,000 times offering one theory as to a possible motivation.

“He’s moving to Florida because of a unique unlimited Homestead provision in our Constitution letting him keep a home of any value, said @20thgrader:

Most states with a homestead provision cap it at some reasonable amount, many in the $300,000 range. In Florida, your house can be worth $25,000,000.00 and you get to keep it under insolvency (if it’s paid off).

As the real estate news site TheRealDeal.com reported in October 2018, Florida is one of six states without a cap on what is known as a “homestead exemption” protecting homes from creditors. That exemption is broad enough that, because of a 2011 ruling by the Florida Supreme Court, it covers homes bought with “the specific intent of hindering, delaying, or defrauding creditors.”

According to The Real Deal:

The ruling has turned into a nightmare for lenders and asset-recovery lawyers nationwide. Because many debtors across the U.S. can, in theory, move to Florida at a moment’s notice and buy a house, they know that a part of their fortune equivalent to the value of a hypothetical Florida mansion can’t ever be seized by creditors. Of all of Florida’s eccentric laws, the homestead exemption is the one it sort of managed to force on the rest of the country as well.

“We’ll have a lawsuit against somebody where they will say ‘You can sue me, and might even win, but by the time you win I’m going to sell my house up here and all my other assets and I’m going to buy a house in Florida’,” said Schuyler Carroll, a New York-based asset-recovery attorney at Perkins Coie, adding that he’s been involved in dozens of cases where the exemption came up. “So we settle.”

It is unclear whether the president will attempt to claim the exemption. It does not cover homes bought “with proceeds from criminal activity,” or homeowners who do not pay taxes or mortgage payments on their property.