In December 2020, a number of Facebook users shared a post about U.S. President-Elect Joe Biden and “stepped up basis,” a very vague term with which few users were likely to already be familiar.

The same text was circulating as early as October 2020:

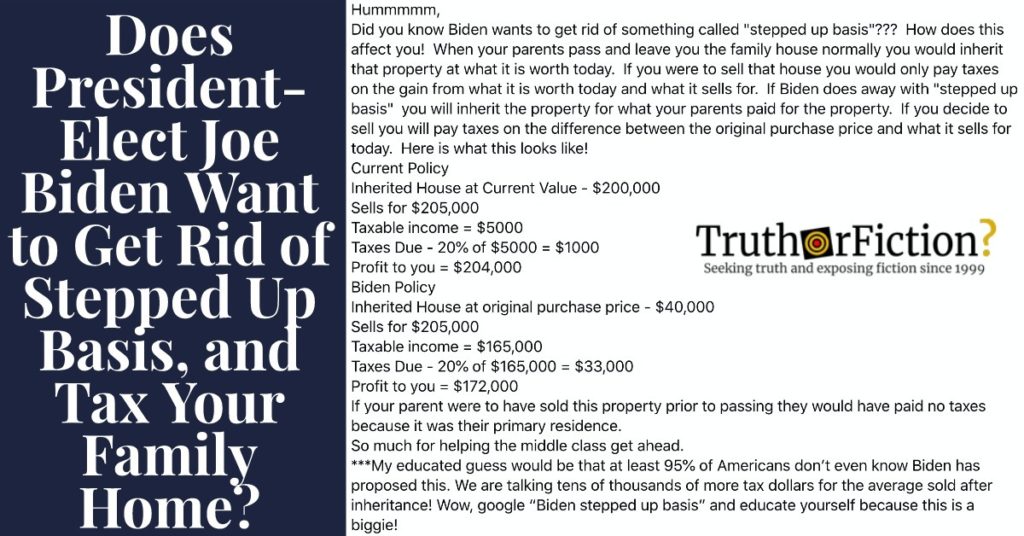

Did you know Biden wants to get rid of something called “stepped up basis”?

How does this affect you! When your parents pass and leave you the family house, normally you would inherit that property at what it is worth today. If you were to sell that house you would only pay taxes on the gain from what it is worth today and what it sells for. If Biden does away with “stepped up basis,” you will inherit the property for what your parents paid for the property. If you decide to sell you will pay taxes on the difference between the original purchase price and what it sells for today. Here is what this looks like!

Current Policy

Inherited House at Current Value – $200,000

Sells for $205,000

Taxable income = $5000

Taxes Due – 20% of $5000 = $1000

Profit to you = $204,000Biden Policy

Inherited House at original purchase price – $40,000

Sells for $205,000

Taxable income = $165,000

Taxes Due – 20% of $165,000 = $33,000

Profit to you = $172,000If your parents were to have sold this property prior to passing, they would have paid no taxes because it was their primary residence.

So much for helping the middle class get ahead.

My educated guess would be that at least 95% of Americans don’t even know Biden has proposed this. We are talking tens of thousands of more tax dollars for the average sold after inheritance! Wow, google “Biden stepped up basis” and educate yourself because this is a biggie! Please share!

Neither the origin of the “Biden ‘stepped up basis'” post nor the date on which it started circulated were apparent, as people frequently copied the post into a text-based status update, which was then shared by others. The claim appeared to spike in popularity on December 18 2020.

Claims Made About President-Elect Joe Biden and ‘Stepped Up Basis’

The original claim was that anyone whose parents left them “the family house” would inherit it based on its current value. So if a parent died and willed their home to a child or children, and that home had considerably gone up in value since it was purchased, the child would inherit the property at its current worth.

In addition, the beneficiary of the willed family home would owe taxes on the difference between its value and, if the beneficiary elected to sell the home, the sale price.

Before providing mathematical examples of the difference between existing “stepped up basis” and what Biden purportedly proposed, the poster described the difference. Although the putative beneficiary in the “stepped up basis” example would owe taxes on the difference between the home’s value and sale price, the second scenario was presented differently.

Without “stepped up basis,” the beneficiary would not inherit the house at its current value; rather, the value of the inheritance would be based on the price the putative parents paid for it at the time it was sold — which might often be a very large difference when many homes had leapt in value by hundreds of thousands of dollars between the 1950s through 1980s and 2020.

In that second scenario, should the beneficiary opt to sell the family home, taxes owed would be on the difference between the price originally paid (even fifty or more years before) and the current appraised value of the home.

What followed were two scenarios, one where “stepped up basis” shielded the beneficiary from a larger tax burden, and another where the tax burden was heftier. In both examples, the 2020 value of the inherited property was $200,000; the example included a sale price of $205,000.

In the “stepped up basis” example, the beneficiary (A) inherited a house worth $200,000 and sold it for $205,000. Of the $205,000 sale price, $5,000 was considered “taxable income” and it was taxed at 20 percent in the example — $1,000 being 20 percent of $5,000. Beneficiary (A) walked away from the deal with $204,000 in profit, the sale price less $1,000 in tax.

In the second example where Biden “did away” with “stepped up basis,” beneficiary (B) inherited the same house worth $200,000 — but on paper, the value of their inheritance was the $40,000 their parents paid for the house originally. When beneficiary (B) sold the same $200,000 house for $205,000 after inheriting it, they were taxed on the difference between $205,000 and $40,000 — $165,000. In the second example, the same 20 percent rate was applied to the proceeds of the sale, and the beneficiary paid $33,000 in taxes — $32,000 more than the “stepped up basis” sale by beneficiary (A).

Although both (A) and (B) inherited the same property purchased at $40,000 and willed to them valued at $200,000, and both sold it at $205,000, (A) walked away with $204,000 in profit, less $1,000 in taxes. Beneficiary (B) still did well, making $172,000 in profit, but paid $32,000 more in taxes.

Median Home Values in 2020

As a gauge, the prices and amounts provided in the example were modest when compared to median home prices in 2020 in the United States.

An August 2020 Fool.com item contrasting 2020 home prices in each state and across all 50 states reported that the median home price in the United States in 2020 was just over $295,000 — significantly higher in states like California and Hawaii, and lower in states like West Virginia:

- The median existing home price was $295,300 in June 2020.

- Hawaii has the highest median home value in the U.S. at $646,733.

- California has the highest median home value in the continental U.S. at $579,332.

- West Virginia has the lowest median home value in the U.S. at $107,064.

That same report provided a median home value of $30,200 in 1973, and $222,900 in 2010. By October 2020, real estate Redfin maintained that the $295,300 median home price a few months earlier had spiked to $320,625:

The median home sale price increased 15% year over year to $320,625—the highest on record in Redfin’s data, which goes back through 2012. Although it uses a different methodology to measure home prices, it is worth noting that the largest increase ever recorded in the Case-Shiller national home price index (which goes back through 1988) was 14.5% in September 2005. In the week ending October 4 [2020], home prices were up 16% from the same week a year earlier. Since the four-week period ending July 5, home prices have increased 6.8%. Over that same period in 2018 and 2019, prices declined an average of 4.4%.

Applying those figures to the calculations in the post created potentially higher tax liabilities for beneficiaries, particularly contrasted with a lower median home price in 1973. If an individual inherited a home their parents bought for $30,200 in 1973 and we split the difference between the two figures for median home prices in 2020, beneficiary (C)’s inheritance would be worth $307,962.50. In that scenario, if beneficiary (C) sold the home for an even $310,000 and were taxed on the difference between the sale price and the purchase price of the home, the taxable amount would be $279,800.

Under “stepped up basis,” (C) would be taxed 20 percent of the $2,037.50 between the appraised price and the home’s value, or $407.50. But in the scenario without stepped up basis, beneficiary C would pay 20 percent tax on $279,800, a sum of $55,960, meaning they would walk away with $223,840 in the second scenario (versus $279,800.)

This, of course, depends on three big variables: Whether the claim was accurate, whether “stepped up basis” actually existed, and whether Joe Biden sought to eliminate it.

What is ‘Stepped Up Basis’? Is it a Loophole for the One Percent?

When you Google “stepped up basis” as the post instructs, the results shows that there are many searchers for “stepped up basis Biden.” But the balance of related searches suggested a possibly more complex scenario.

They were:

- “stepped up basis Biden”;

- “stepped up basis trust”;

- “stepped up basis upon death,” and;

- “stepped up basis loophole.”

The last of the four, “stepped up basis loophole,” hinted at the possibility that the “middle class” mentioned in the post might not be the main targets of changes to “stepped up basis” and taxes. But it still didn’t define “stepped up basis.”

We found an analysis of the term on Investopedia, which began:

A step-up in basis is the readjustment of the value of an appreciated asset for tax purposes upon inheritance.1 The higher market value of the asset at the time of inheritance is considered for tax purposes. When an asset is passed on to a beneficiary, its value is typically more than what it was when the original owner acquired it. The asset receives a step-up in basis so that the beneficiary’s capital gains tax is minimized. A step-up in basis is applied to the cost basis of property transferred at death.

Investopedia provided a “Key Takeaways” section, explaining:

- A step-up in basis readjusts the value of an appreciated asset over a period of time for tax purposes.

- It is used to calculate tax liabilities for inheritance assets.

- Economists have proposed eliminating step-up in basis and have suggested that it could be replaced with lower capital gains taxes.

The third bullet point suggested that if Joe Biden opposed “stepped up basis,” he was not alone; economists suggested lowering capital gains taxes overall to offset tax liabilities as they related to inheritances.

Like the Facebook post, Investopedia provided two examples of inheritances and how they might be affected by stepped up basis:

A step-up in basis reflects the changed value of an inherited asset. For example, an investor purchasing shares at $2 and leaving them to an heir when the shares are $15 means the shares receive a step-up in basis, making the cost basis for the shares the current market price of $15. Any capital gains tax paid in the future will be based on the $15 cost basis, not on the original purchase price of $2.

The step-up in basis rule changes tax liability for inherited assets in comparison to other assets. For example, Sarah bought a loft in 2000 for $300,000. When Paul inherited the loft after Sarah’s death, the loft was worth $500,000. When Paul sold the loft, his tax basis was $500,000. He paid taxes on the difference between the selling price and his stepped-up basis of $500,000. If Paul’s cost basis were $200,000, he would have paid much more in taxes when selling the loft.

Very simply put, the taxation principle of stepped up basis meant that under tax code, a person was liable for taxes on the current value of an inherited asset (be it a home, stock, or other property), not the difference between the original purchase price (“cost basis”) and its “stepped up” value at the time in came into the beneficiary’s possession.

Investopedia’s “Stepped-up Basis” entry included a section (“Step-Up in Basis as a Tax Loophole”) which addressed purportedly common criticisms that stepped up basis is tax shelter not for the middle class, but for those with significant wealth. Investopedia cited the Walton family as an example of the very wealthy shielding themselves from paying their fair share by converting assets and money into “estates” to evade taxation:

The step-up in basis tax provision has often been criticized as a tax loophole for the ultra-rich and wealthy. They take advantage of it to eliminate or reduce their tax burden. For example, they can escape capital gains tax on stocks by placing their holdings in a trust fund for their heirs.

[…]

The investor’s heirs will enjoy the benefits of the investment after their death because they will be taxed on the stepped-up cost basis, instead of the original cost, thereby allowing them to evade taxes worth millions of dollars. The case of the Walton family, which owns Walmart and is supposed to have put a majority of its holdings into estates to avoid taxes, is well-known.

Who Primarily Benefits from Stepped Up Basis, and What Do Experts Have to Say About It?

The Tax Foundation, a “center-right” and “business-friendly” think tank focused on American tax policy, examined discourse surrounding stepped-up basis in March 2019, reiterating that the primary beneficiaries of such policies are not the “middle class” as suggested in the viral Facebook post:

… Step-up in basis reduces capital gains tax liability on property passed to an heir by excluding any appreciation in the property’s value that occurred during the decedent’s lifetime from taxation.

This policy has been critiqued for its “lock-in effect,” that it discourages taxpayers from realizing capital gains by allowing a deceased person’s returns from saving, in the form of capital gains, to be passed on to heirs without tax. This reduces federal revenue and benefits mainly high-income taxpayers.

The Tax Foundation described stepped up basis as a “non-neutral tax expenditure” adding that “[a] step-up in basis would allow the returns from a decedent’s saving to escape tax completely, so long as the asset is passed to an heir,” and explaining once again that the primary beneficiaries of the policy are not middle-class Americans:

This lock-in effect reduces federal revenue and primarily benefits wealthier taxpayers. Wealthier taxpayers are generally in a better position to pass property on at death than less wealthy taxpayers, who must spend down resources in retirement. Step-up in basis has also been criticized on the grounds that its lock-in effect deters taxpayers from reinvesting capital gains earnings in other areas of the economy. The importance of eliminating step-up in basis as a way to spur U.S. investment is overstated. The U.S. is an open economy with access to a large amount of global saving and doesn’t need to rely solely on U.S. saving to fund investment opportunities. In fact, eliminating step-up in basis would likely reduce the incentive to save as it would increase the marginal effective tax rate on saving in the U.S.

[…]

Although step-up in basis deserves skepticism as a nonneutral tax expenditure that reduces revenue and primarily benefits wealthy taxpayers, it also mitigates the double taxation of investment income and the economic harm produced by the estate tax. Step-up in basis also makes life simpler for taxpayers that receive property in an estate.

According to the “business-friendly” Tax Foundation, average or middle class wage earners are typically in a position necessitating they “spend down” their accumulated wealth in retirement (in order to survive without income earned by working). As such, “less wealthy taxpayers” are far less frequently in a position to accumulate and distribute property or assets at the time of their death — therefore, high income earners and their beneficiaries are likelier to benefit from the stepped up basis policy.

The Tax Foundation concluded that the elimination of stepped up basis represented a “difficult call” for lawmakers. The organization stated that “eliminating step-up in basis removes a nonneutral tax expenditure that reduces federal revenue and primarily benefits wealthy taxpayers,” but that “eliminating … step-up in basis would also increase the compliance burden for heirs, who would have to verify the original cost basis of property upon a decedent’s death.”

In November 2019, the “progressive” or “liberal” Center on Budget and Policy Priorities (CBPP) provided an alternate analysis of stepped up basis, the middle class, and the “ultra wealthy,” titled “Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks.”

On the whole, CBPP maintained that the entirety of the tax code burdened individuals whose wealth was earned rather than inherited, while allowing people who did not work for a living to evade taxes (expounded upon in a section titled “Income From Wealth Is Taxed More Lightly Than Income From Work”):

A critical tax advantage for wealthy households is that much of their income doesn’t appear on their annual tax returns because the tax code doesn’t consider it “taxable income.” For example, taxes on capital gains (the increase in the value of assets such as stocks, real estate, or other investments) are effectively voluntary to a substantial extent: high-wealth filers may accumulate capital gains every year as their investments appreciate, but they don’t owe tax on those gains until — or unless — they “realize” the gain, usually by selling the appreciated asset. Wealthy individuals can wait to sell until it makes the most sense for them, such as a year in which they will have large capital losses to offset the gain. And, if a wealthy individual opts instead to pass on her appreciated assets to her son when she dies, neither she nor her son will ever owe capital gains tax on the assets’ growth in value during her lifetime. In contrast, people who earn their income from work (for example, from wages or salaries) typically have income and payroll taxes withheld from every paycheck; if their tax liability for the year exceeds those withheld taxes, they must pay the balance by the following April 15.

Further, a significant part of the income that does show up on wealthy households’ annual tax returns is taxed at preferential rates. Capital gains and dividends are taxed at a maximum income tax rate of 20 percent, far below the 37-percent top rate on wages and salaries.

CBPP broadly called for efforts to balance out the tax burden and argued that it favored the wealthy while crushing taxpayers without significant assets — citing a maximum tax of 20 percent on capital gains versus a top rate of 37 percent on wages. It further stated that lawmakers could “have a number of ways to raise more revenue from the most well-off … [which] fall into two broad categories,” and addressed stepped up basis in its first of two bullet points:

Expanding the types of income considered taxable. For example, instead of waiting to tax capital gains until assets are sold, the tax code could impose a “mark-to-market” system, which would impose tax annually on the gain in value of assets that high-income individuals hold, whether or not they are sold. Policymakers also could repeal the “stepped-up basis” tax break, which enables wealthy people who have avoided capital gains taxes on the growth of assets during their lifetimes to pass them to their heirs free of capital gains tax.

CBPP added that “Deferral of Capital Gains Income” was a major contributor to income inequality, once again addressing stepped up basis as one of the ways in which very wealthy people avoid being taxed in the same manner wage earners are taxed:

Unlike other types of income, like wages, the amount of capital gain claimed on a tax return is often effectively voluntary due to the “realization principle,” which means that a capital gain is only taxed when the capital gain is “realized,” typically when the asset is sold. Only part of capital gains are realized in any given year. The rest are deferred, and no tax is immediately due, even if the unrealized capital gain makes up a significant share of a household’s income as reflected in the growth of its net worth.

The ability to defer capital gains taxes confers three benefits on taxpayers who can take advantage of this tax break:

- Instead of paying taxes each year on their capital gains, they can continue earning returns on the money that they would have paid in tax, and these returns compound over time. Delaying by decades the day when taxes are due is a large benefit.

- They can wait to sell assets until doing so is beneficial for other tax reasons. They may wait, for example, until a year in which they will be in a lower tax bracket or will have large capital losses to offset the gains, or they may hold on to assets in hopes of a future capital gains tax-rate cut. Wage earners typically do not have this option since they owe tax on their income in the year they receive it.

- They can take advantage of many of the other tax benefits for capital gains discussed below, such as stepped-up basis.

In sections addressing 2017 changes to the tax code and the manner in which they benefitted the wealthy at the expense of the middle class, CBPP said:

The 2017 tax law eliminated like-kind exchanges for certain assets (such as vehicles, equipment, and artwork) but retained them for real estate, so wealthy real estate investors can continue to sell buildings without claiming the gains from those sales on their income tax returns. In fact, they can buy and sell properties throughout their lives and never pay tax on the gains — and then combine this tax avoidance with stepped-up basis at death to avoid tax liability completely, as the next section of this paper explains.

A subsection titled “Stepped-Up Basis” specifically addressed stepped up basis and who benefited from it — using the late Steve Jobs of Apple as an example of stepped up basis enabling billions of dollars to be “permanently exempt from income tax”:

One of the tax code’s largest subsidies for capital gains is the stepped-up basis tax break. If an investor holds on to an asset (such as stock) and passes it on to an heir instead of selling it, neither she nor her heir owes capital gains tax on its increase in value during her lifetime. (Technically, the asset’s basis — or the price paid for it — is “stepped up” to its fair market value at the time of inheritance.) Stepped-up basis encourages wealthy people to turn as much of their income into capital gains as possible and hold on to assets until death, when a lifetime of gain becomes permanently exempt from tax. (The asset, however, may be subject to the estate tax, as explained below.)

Combined with the benefits of deferral and the other targeted capital gains tax breaks discussed above, stepped-up basis allows large corporate stockholders and other wealthy investors to pay no income tax on the increase in assets’ value during their lifetimes and then pass the assets on to their heirs, who pay no income tax on those inheritances. For example, Steve Jobs, the former Apple CEO, received an annual salary of $1, as reported on the company’s SEC filings. Instead of a traditional salary, he received shares of Apple stock worth $75 million in the early 2000s. He likely paid ordinary income tax on the value of those shares when he received them as income. But because he never sold the shares during his lifetime, he never paid tax on the subsequent massive gain as Apple’s stock skyrocketed. At his death, Jobs’ Apple stock was worth roughly $2 billion, and all of that gain was permanently exempt from income tax.

CCBP also addressed the middle class and stepped up basis, noting that U.S. President Barack Obama had proposed eliminating the “loophole” element of stepped up basis, while still allowing for moderate transfers of accumulated wealth for the middle class:

Ending Stepped-Up Basis

Policymakers should repeal stepped-up basis by taxing the unrealized capital gains of affluent households when appreciated assets are transferred to heirs.

[…]

Such a measure can be designed to shield most or all middle-class households. President Obama proposed repealing stepped-up basis for most capital gains over $350,000 (including $250,000 for personal residences and $100,000 of other gains). Such thresholds could be set where policymakers want to place them. President Obama’s proposal also would have retained rules allowing taxpayers to donate property to charitable organizations tax-free while allowing a deduction equal to the property’s fair market value, thereby exempting from federal income tax the appreciation that occurred while the taxpayer held the assets. JCT estimated that the Obama proposal, along with an increase in the maximum rate on capital gains and dividends to 28 percent, would have raised $250 billion over ten years.

If you were to apply Obama’s proposal to the examples in the post, the beneficiary of the inherited $200,000 home would not be taxed an extra $32,000 — because that proposal was specifically crafted to exempt sums under $350,000. In a briefing updated in May 2020, TaxPolicyCenter.org also indicated that Obama proposed exempting the middle class from changes to stepped up basis.

So, Does Joe Biden Want to Get Rid of Stepped Up Basis?

Much of the information we reviewed came before Biden’s presidential run and his subsequent election, and the points were discussed without tacking proposals to any specific person.

In March 2020, CNBC reported that Biden’s proposed changes to the tax code indeed addressed the “huge loophole” of stepped up basis, in an article titled “This is how Joe Biden will tax generational wealth transfer.” CNBC opened by asserting that analyses identified Biden’s plan as targeting wealthy Americans (not the middle class):

Former vice president Joe Biden’s $4 trillion tax plan would raises taxes on higher income households both in life and at death, according to analysis by the Tax Policy Center. The Democratic presidential contender proposed a raft of tax policy changes that would raise levies on the wealthy, including boosting individual income tax rates on households with taxable income over $400,000, according to the center’s study.

CNBC explained that “the tax provision wealthy households hold most dear is a decades’ old corner of the tax code known as the ‘step-up in basis,” adding:

“It’s an enormous loophole in the law, the step-up in basis,” said Jonathan Blattmachr, estate attorney and principal at InterActive Legal. “You get the step-up in basis even if you don’t pay the estate tax.”

By taxing the unrealized gain at death, heirs would get hit at the transfer, regardless of whether they sell the asset, [Howard Gleckman, senior fellow in the Urban-Brookings Tax Policy Center] said.

The capital gains tax bite under the former vice president’s plan would also be harsher than it is now.

Under the current framework, the long-term capital gains tax rate is 20% for single households with more than $441,451 in taxable income ($496,601 for married-filing-jointly) in 2020.

Biden’s proposal would increase capital gains taxes by subjecting gains to the same tax rate as ordinary income for households earning more than $1 million.

CNBC’s reporting was based on an extremely detailed study published by the Tax Policy Center in March 2020, which noted that “candidates’ proposals rarely include all the details needed to model them accurately,” and the group submits requests to their “staff to clarify provisions or specify more details.” Stepped up basis was not mentioned by name in the analysis, but a portion of the analysis titled “Individual Income Taxes” included three likely relevant bullet points.

Each bullet point included assumptions from the Tax Policy Center, which are bracketed below:

- Cap itemized deductions at 28 percent of value. [We assume the proposal applies only to itemized deductions and does not apply to employer-provided health and retirement benefits.]

- Tax capital gains and dividends at the same rate as ordinary income for taxpayers with over $1 million in income. [We assume the proposal adds a fourth bracket for long-term capital gains and qualifying dividends (resulting in brackets of 0 percent, 15 percent, 20 percent, and 39.6 percent.)]

- Tax unrealized capital gains at death. [We assume the proposal’s exemption and treatment of gifts and transfers to spouses and charity is the same as (detailed by extant tax code.)]

Those assumptions made by the Tax Policy Center fleshed out granular elements of a tax plan based on additional information provided by campaign staff and likely outcomes. Biden’s plan specifically identified taxpayers with more than $1 million in income — hinting at exemptions for the middle class.

A threshold of $1 million in annual income was mentioned twice:

[Biden’s] plan would tax capital gains and dividends at the same rate as ordinary income for taxpayers with incomes above $1 million and tax unrealized capital gains at death.

The Tax Policy Center revisited Biden’s tax plan based on new information in November 2020, but the analysis remained the same:

[Biden’s] plan would tax capital gains and dividends at the same rate as ordinary income for taxpayers with incomes above $1 million and tax unrealized capital gains at death.

Additional November 2020 analysis from the organization included the same high thresholds that were not applicable to our Facebook example:

Further, his plan would lower the estate tax exemption to $3.5 million ($7 million for married couples) and increase the estate tax rate to 45 percent.

[…]

About half of the revenue gains would come from higher taxes on high-income households and high-value estates, and about half would come from higher taxes on businesses, especially corporations.

In the “Individual Income Taxes” section, a portion included Biden’s plan details, and a projection:

Restore the nominal estate, gift and generation-skipping transfer tax parameters in effect in 2009. We assume … the exclusion amount would be $3.5 million for estate and generation-skipping transfer taxes, would be $1 million for gift taxes, and would not be indexed for inflation.

An unrelated assessment addressed the broader impact of Biden’s proposed changes on the middle class, adding:

Middle-and lower-income taxpayers would benefit from expanded and new tax credits. Biden’s plan would temporarily increase the child tax credit and make it fully refundable and permanently boost the child and dependent care tax credit and make it fully refundable as well. His plan would provide new tax credits for first-time home buyers, family caregivers, and low-income renters. His plan would make tax incentives for retirement saving more progressive by replacing a deduction(or income exemption) with a refundable tax credit for contributions to traditional individual retirement accounts(IRAs) and defined-contribution pension plans.

PolitiFact looked into the exact same Facebook post in October 2020, rating the claim Joe Biden wanted to “do away with” stepped up basis as “true.” PolitiFact based its rating on three sources — including an October 2019 ABC News article about Biden’s college plan, which only addressed the claim in passing:

The [college] plan would be paid for through the elimination of the stepped-up basis loophole, a type of break on inheritance taxes, and capping itemized deductions for wealthy Americans at 28%, according to the campaign.

ABC News did not provide any additional detail about the elimination of “the stepped-up basis loophole,” or whether exemptions applied — highly relevant to the Facebook post PolitiFact marked “true.” The outlet also cited a different CNBC article from June 2020, which once again did not actually detail the manner in which Biden might reduce stepped up basis.

The sum total of included information was a quote repeated at the top and in the body:

“Folks, this is going to be really hard work and Donald Trump has made it much harder to foot the bill,” Biden said, according to a Wall Street Journal reporter’s press pool report about the event.

But even before the coronavirus crisis effectively froze the U.S. economy and sent unemployment skyrocketing, Trump’s “irresponsible sugar-high tax cuts had already pushed us into a trillion-dollar deficit,” Biden said.

“I’m going to get rid of the bulk of Trump’s $2 trillion tax cut,” Biden continued, “and a lot of you may not like that but I’m going to close loopholes like capital gains and stepped-up basis.”

The third and final citation upon which PolitiFact based their “true” rating in October 2020 was an opinion editorial in The Hill from July 2019. It was headlined, “Stop giving away capital gains taxes,” and it mentioned Biden only in passing:

There is a rule that has been part of the tax code for nearly a century that safeguards the wealth of the rich, but violates nearly every principle of sound tax policy. Yet it persists, costing our national coffers $40 billion or so each year. Even by federal government standards, this is a significant dollar figure today. Indeed, stumping on the campaign trail, presidential candidate Joe Biden proclaimed that closing this loophole could pay the tuition for all qualified applicants to attend community college for free.

This arcane rule is colloquially known as the “step up in basis” rule. It dictates that, to compute gains and losses, a taxpayer who sells an asset that he or she inherited must use the fair market value of the asset at the date of the death of the individual bestowing it, rather than the original purchase price, also known as cost basis, which is typically much lower.

That editorial focused solely on the author’s belief that the stepped up basis loophole ought to be eliminated, and no detail of Biden’s mentions of it was included — only that Biden ” proclaimed that closing this loophole could pay the tuition for all qualified applicants to attend community college for free.” The piece concluded with the following opinion:

The “step up in basis” rule in the tax code meets the criterion that it is a wholesale subsidy to the wealthy that has lasted much longer than the administrative rationale that had propelled and underpinned its existence. The only question is whether politicians will demonstrate the necessary leadership skills and courage to educate the public that the United States is in dire need of a tax code that will conform to the pressing economic needs of today, not one mired in all the obsolete concerns of yesterday.

What’s True, What’s False, and What’s Unknown about Biden’s Step Up Basis Proposal

Back in July 2019, the Tax Foundation unpacked Biden’s early tax plan, and said:

Currently, when a person dies and leaves property to an heir, the basis of that property is increased to its fair market value. This “step-up in basis” means that any capital gains that occurred during the decedent’s life go untaxed. When the heir sells that property, any capital gains taxation will be assessed based on the heir’s new basis. Step-up in basis reduces the tax burden on transferred property, as the total value of transferred property is already taxed by the estate tax.

Biden’s plan would first raise taxes on capital gains by treating them as ordinary income for those earning more than $1 million.

In February 2020, the group said:

Repealing step-up in basis almost exclusively affects taxpayers in the top 20 percent. Most notably, the distributional effect is almost four times larger for those in the top 1 percent relative to those in the top 20 percent. Since the top 1 percent own a greater percentage of assets subject to the deferral treatment provided by step-up in basis, a repeal affects those filers more significantly.

A November 2020 Forbes analysis focused on Biden and the step up basis debate, noting that the change was unlikely to come to fruition:

Ahead of the 2016 election, President Donald Trump backed a plan that would have eliminated estate and gift taxes and liquidated step-up in basis, in addition to lowering the corporate tax rate to 15% from 35%. When it came time to pass legislation, though, the 2017 Tax Cuts and Jobs Act only cut the corporate rate to 21% from 35% and doubled the estate tax exemption. Step-up in basis survived unscathed.

And an October 20 2020 Iowa State University analysis explained that primarily, the granular details of the proposal were unspecified and addressed the extremely wealthy:

Biden has proposed eliminating the basis adjustment at death, meaning that heirs would receive a carryover basis on inherited assets, rather than a basis adjusted to fair market value. In other words, transfers at death would presumably be treated like lifetime gifts. The Biden website does not reference details on this proposal, but rather says only that “capital gains reform will close the loopholes that allow the super wealthy to avoid taxes on capital gains altogether.”

Conclusion

A Facebook post circulating from at least October 2020 urged users to “Google ‘Biden stepped up basis’ and educate yourself because this is a biggie,” claiming Joe Biden proposed a tax code change aimed at middle class people inheriting family homes. Users who googled “Biden stepped up basis” would find a PolitiFact fact-check rating the claim “true,” which seemed incomplete or misleading. Nearly all analysis deemed “stepped up basis” a “loophole” used to exempt millions and billions of dollars in capital gains from ever being taxed, and President Barack Obama’s earlier proposal exempted the amounts in the Facebook post — a fairly important piece of context.

Ultimately, there does not seem to be a lot of detail as yet available on what were very likely exemptions under a million or more dollars, and so we rate the veracity of these claims Unknown — Biden has proposed eliminating stepped up basis, but existing information suggested it was likely sums under a million dollars would be exempted should the proposal come to pass.

- google “Biden stepped up basis” and educate yourself

- google “Biden stepped up basis” and educate yourself

- google “Biden stepped up basis” and educate yourself

- google “Biden stepped up basis” and educate yourself

- Average House Price by State in 2020

- U.S. Home Prices Up a Record 15%

- Step-Up in Basis

- Tax Foundation

- The Trade-offs of Repealing Step-Up in Basis

- Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks

- What is the difference between carryover basis and a step-up in basis?

- This is how Joe Biden will tax generational wealth transfer

- An Analysis of Former Vice President Biden’s Tax Proposals

- An Updated Analysis of Former Vice President Biden's Tax Proposals

- Joe Biden “wants to get rid of something called ‘stepped up basis’” that reduces inheritance taxes.

- Biden pitches 2 years of free community college in higher-education plan

- Biden tells donors: I’m going to get rid of most of Trump’s tax cuts ‘and a lot of you may not like that’

- Stop giving away capital gains taxes

- Unpacking Biden’s Tax Plan for Capital Gains

- Analysis of the Economic, Revenue, and Distributional Effects of Repealing Step-up in Basis

- What A Biden Win Means For Tax Policy

- A Look at Biden's Tax Proposals