On March 15 2021, @Hamdia_Ahmed tweeted about homeless people not having access to the first or second stimulus payments — adding that anyone who is experiencing homelessness could receive the third stimulus with something called an “EIP return”:

Urging others to retweet the tweet, Ahmed wrote:

I was really upset that homeless people did not have access to the $1,400 stimulus check.

I just found this out. If you are homeless, you can go to a tax return office where they will file something called EIP return. They will put the money on a debit card after.

Ahmed’s tweet was widely shared and appeared to enter Google Trends, but it also involved a few concepts impossible to articulate with a limited number of characters on Twitter.

Why Homelessness Matters Even More in 2021

Sobering but unsurprising research reported in January 2021 indicated that the events of 2020 exacerbated the risk of homelessness in the United States, and that more Americans were expected to lack housing in the coming years:

COVID-19 will cause twice as much homelessness as Great Recession, researchers say

… Over the next four years, the COVID-19-related recession is expected to cause chronic homelessness to increase some 49% nationwide, according to new research from the Economic Roundtable, a non-profit urban research organization based in California. The homelessness crisis is expected to peak in 2023, researchers found, with an additional 603,000 working-age adults without a place of their own to sleep.

[…]

The situation will be even worse in California, which was already the epicenter for the country’s homelessness problem before the pandemic. Chronic homelessness is expected to increase 68% in the Golden State, with an additional 131,400 homeless adults. Of these people, over a third will be located in Los Angeles County alone.

In March 2021, more people were homeless than in March 2020, and homelessness was still on the rise. Consequently, connecting homeless people with funds was more important and more relevant than ever.

What Is an EIP? What’s an ‘EIP Return’?

At first, we didn’t recognize the “EIP” abbreviation.

People who have visited the Internal Revenue Service (IRS) website might recognize the acronym — “EIP” stands for “Economic Impact Payment”:

Economic Impact Payments are funds to help people during the coronavirus pandemic.

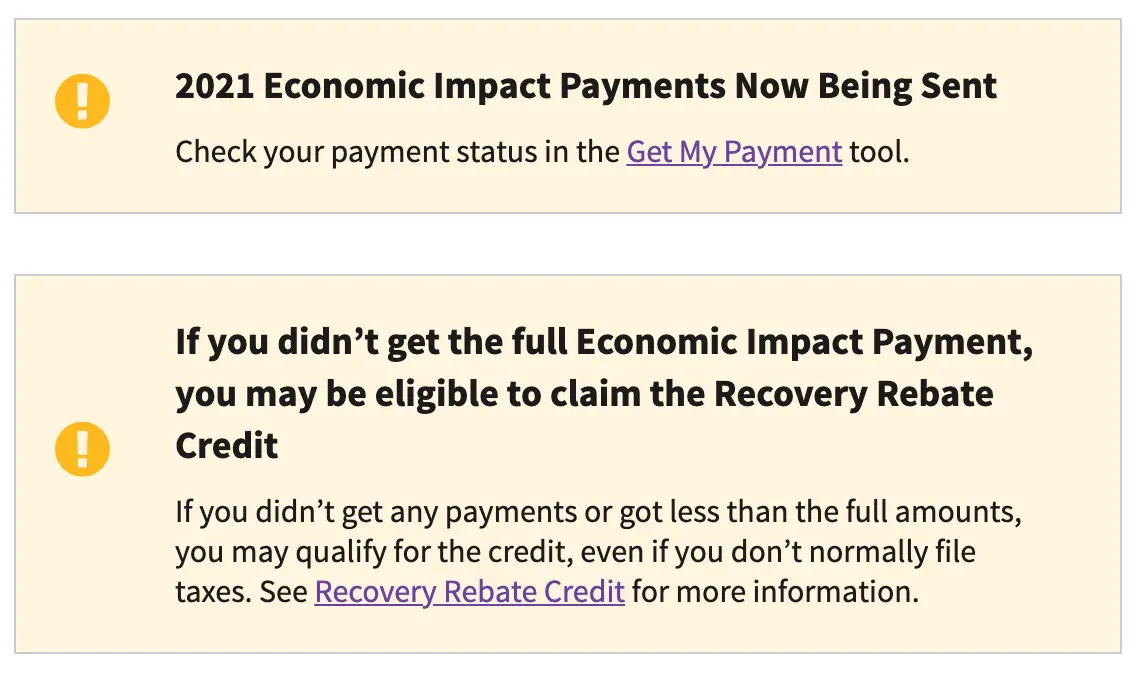

A number of Americans likely used the IRS “Get My Payment” tool for the first and second stimulus payments. Under the EIP explanation, a section read:

The 2021 Economic Impact Payments are now on the way.

We’re now sending the 2021 Economic Impact Payments in accordance with the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Check when and how your payment was sent with the Get My Payment tool.

After that, the blue “Get My Payment” button appeared. After that, the second part of the page explained:

Didn’t Get the Full First and Second Payments? Claim the 2020 Recovery Rebate Credit

If you didn’t get the full amount of the first or second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t normally file. The third Economic Impact Payment will not be used to calculate the 2020 Recovery Rebate Credit.

2020 Tax Returns and the Third Stimulus (or American Rescue Plan)

A second button was labeled “Claim 2020 Recovery Rebate Credit.” Clicking led to a page titled “Recovery Rebate Credit,” and nothing on the page referenced having (or not having) a fixed address or a bank account, nor did it expressly articulate what might have prevented Americans from receiving the first and second stimulus checks.

After explaining that all funds had been disbursed for the first two rounds of stimulus payments, the IRS added:

If you’re eligible for the credit, and either we didn’t issue you any Economic Impact Payments or we issued less than the full amounts, you must file a 2020 tax return to claim the Recovery Rebate Credit even if you are not required to file a tax return for 2020.

Economic Impact Payments were based on your 2018 or 2019 tax year information. The Recovery Rebate Credit is similar except that the eligibility and the amount are based on 2020 information you include on your 2020 tax return.

That emphasized portion mentioned “2020 information … on your 2020 tax return.” It bears mentioning that a “2020 tax return” would typically be filed between January 1 and mid-April 2021.

It continued:

You will need to know the amount of any Economic Impact Payments issued to you to claim the Recovery Rebate Credit. If you’re eligible for the Recovery Rebate Credit on your 2020 tax return, it will be reduced by any Economic Impact Payments we issued to you. Always be complete and accurate when you file a return.

File electronically and the tax software will help you figure your Recovery Rebate Credit. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in your community or finding a trusted tax professional.

The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040-SR instructions can also help determine if you are eligible for the credit.

Anyone with income of $72,000 or less can file their Federal tax return electronically for free through the IRS Free File Program. The fastest way to get your tax refund is to file electronically and have it direct deposited – contactless and free – into your financial account. You can use a bank account, prepaid debit card or mobile app for your direct deposit and will need to provide routing and account numbers.

For more detailed information see the Recovery Rebate Credit Frequently Asked Questions.

Further Information from the IRS

We visited “Recovery Rebate Credit Frequently Asked Questions,” but the page made no mention of people with no fixed address. We then searched the IRS site for “homeless.”

None of the search results had to do with the 2021 “third stimulus” specifically, but one April 28 2020 page was titled “Use IRS Non-Filers: Enter Payment Info Here tool to get Economic Impact Payment; many low-income, homeless qualify.”

The first section on the page, confusingly, mentioned Spanish-language access for IRS.gov users, but went on to include information for homeless people:

IR-2020-83, April 28, 2020

WASHINGTON – The Internal Revenue Service today reminds low-income Americans to use the free, online tool Non-Filers: Enter Payment Info Here to quickly and easily register to receive their Economic Impact Payment.

The IRS has recently released a new Spanish language version of the tool to help even more Americans get their money quickly and easily.

“The IRS is working hard to find new ways for people who don’t have a filing requirement to receive their Economic Impact Payment,” said IRS Commissioner Chuck Rettig. “The Non-Filers tool is an easy way people can register for these payments. I appreciate the work of the Free File Alliance to quickly develop a Spanish-language version of this tool to reach additional people. This is part of a wider effort to reach underserved communities.”

The Non-Filers: Enter Payment Info Here tool is designed for people with incomes typically below $24,400 for married couples or less than $12,200 for single people. This includes couples and individuals who are homeless. People can qualify, even if they do not work. Anyone claimed as a dependent by another taxpayer is not eligible.

Usually, married couples qualify to receive a $2,400 payment while others normally qualify to get $1,200. People with dependents under 17 can get up to an additional $500 for each child.

Just like people who file returns every year, those who do not have a filing requirement also generally qualify for an Economic Impact Payment. The IRS doesn’t know who many of these people are since they normally don’t file. So, the only way to get the Economic Impact Payment is to register with the IRS.

“Homeless” appeared in the title of the page, but we had to search “homeless” on IRS.gov to find it; at first glance, the page appeared to be about a new Spanish version of the site. Subsequently, the IRS’ Commissioner was quoted in a vague statement about “new ways for people who don’t have a filing requirement to receive their Economic Impact Payment,” wording that might not immediately seem relevant to Americans with no fixed address.

Information published by the IRS in April 2020 about people experiencing homelessness or who have no fixed address was in the second part of a paragraph about “non-filers.” It indicated that the “Enter Payment Info Here tool” was for couples or people with incomes under a specific threshold “and individuals who are homeless,” adding that people “can qualify, even if they do not work” (and therefore presumably do not file tax returns).

The IRS added that “like people who file returns every year, those who do not have a filing requirement also generally qualify for an Economic Impact Payment.” Since the relevant information was framed in terms of filing tax returns, it might be easy to miss at first glance — but reading between the lines, it seemed like the IRS was saying that the absence of an annual requirement to file a tax return due to low or no income was not disqualifying.

In the final quoted sentence, the IRS added that people who are not required to file “generally qualify” for EIPs, but that the IRS “doesn’t know who many of these people are since they don’t normally file.” Again, placing EIPs in the context of tax return filings was confusing; the IRS was trying to explain, a bit clumsily, that an unknown number of people are not required to file annually, so the IRS does not know how to get EIPs to them — but that those circumstances do not disqualify them from these payments.

We have not encountered the information about homeless people qualifying for stimulus payments before, and when we found it in March 2021, it was buried in an overly-long press release that initially looked like it was only about Spanish-language resources. But in the middle of the press release, the IRS explained that homeless people “generally” qualify, and added that people who didn’t file wouldn’t automatically receive payments.

In short, the IRS appeared to disclose instructions for homeless Americans no later than April 2020 — but it wasn’t a primary focus at the time, and it wasn’t until Ahmed’s tweet that it entered the discussion.

Can Homeless People Use the ‘Enter Payment Info Here Tool’ in March 2021 for the Third Stimulus?

Based on the April 28 2020 news release, something called the “Enter Payment Info Here tool” was how homeless people and non-filers could receive their stimulus payments.

This is where the process became even more confusing. We located a link to the “Enter Payment Info Here tool” on another page; clicking through led to a page called “Non-Filers: Enter Payment Info Here Tool Is Closed”:

Non-Filers: Enter Payment Info Here Tool Is Closed

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if you’re eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

So the only prominent information returned in a search for “homeless” on IRS.gov advised non-filers to use the “Enter Payment Info Here tool,” a search for which unceremoniously advised March 2021 IRS.gov users that the “tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit.” At the very least, it could be said that those who typically did not file taxes were able to access an authentic IRS experience.

A cursory scan of the page made it sound as if the “Enter Payment Info Here tool” was simply retired from use, and no longer available. However, two yellow boxes appeared at the top of the page:

The second of the two boxes read:

If you didn’t get the full Economic Impact Payment, you may be eligible to claim the Recovery Rebate Credit

If you didn’t get any payments or got less than the full amounts, you may qualify for the credit, even if you don’t normally file taxes. See Recovery Rebate Credit for more information.

Once again, the information appeared at first glance to be irrelevant — but since we first visited the “The 2021 Economic Impact Payments are now on the way” page and the “Recovery Rebate Credit” page, we were aware that “non-filers” were mentioned on those pages.

In September 2020, the FTC also issued some guidance on how people experiencing homelessness might access the first two stimulus payments, which contained some information and a valuable warning:

It’s important to know that only the IRS sends out these payments, but they won’t call, text, or email people about their payments. And they won’t charge a fee. So: anybody who calls, texts, or emails offering to expedite an Economic Impact Payment is a scammer. People should never give anyone money to get a payment: anybody who tells you to pay is a scammer.

Nevertheless, the information was needlessly confusing and difficult to find, even for fact-checkers with unlimited access to computers and the internet.

March 2021 Information for Homeless People and the Third Stimulus

On March 16 2021, Newsweek published an article (“How to Get Your $1,400 Stimulus If You Are Homeless Right Now”) which reported:

Those who haven’t received any stimulus funds so far could still apply to receive all three payments by filing a 2020 tax return and claiming the Recovery Rebate Credit, the IRS advised in early March [2021].

You may qualify for the credit even if you don’t usually file taxes and can file a tax return for free by using the IRS Free File program. See the IRS website for more information on using Free File.

“Even if you don’t have a computer, if you have a smartphone, you can access Free File online and do your tax return.

“If you have no taxable income, simply answer the questions including those requesting information needed to compute the Recovery Rebate Credit,” the IRS said in early March [2021].

[…]

The homeless may receive stimulus payments via Economic Impact Payment (EIP) cards if the IRS does not have any bank account information on them.

A mailing address would be required to receive the EIP Card, which is sent within 15 days according to the IRS.

According to Newsweek, homeless people “could still … receive all three payments” by filing a tax return for 2020 in 2021 — but it requires a mailing address to receive the debit card mentioned in the viral tweet. Newsweek linked to an October 2020 Consumer Financial Protection Bureau (CFPB) document: “Helping Consumers Claim their Economic Impact Payment” [PDF].

That document (subtitled “A guide for intermediary organizations”) was clearly designed for nonprofits and other groups who aided homeless people, rather than homeless people themselves. The word “homeless” appeared twice in its 30 pages, the first being:

For people who were not required to file a 2019 tax return, the fastest way to claim their EIP is to enter their information in the IRS’s Non-Filers Tool on or before November 21st, 2020.

Your programs may serve clients who have not yet received their EIP if you work with:

• Individuals with low income

• Recipients of federal and state cash assistance benefits, Supplemental Nutrition

Assistance Program (SNAP), or Medicaid

• Individuals with insecure housing or who are currently homeless

The above portion only defined “programs” that might help homeless individuals (among others) access EIP payments. The second mention was in a section titled “Using the IRS Non-Filers Tool – Necessary information,” referencing the tool no longer available per the IRS in March 2021:

Common Challenge: Lack of a fixed address; often due to homelessness or a recent move. People need a place where they can receive mail from the IRS. This can be any fixed address where they can securely pick-up mail for an extended period, ideally at least a year. If your client does not have a fixed address, options may include:

• Shelters, service providers or places of worship that hold mail for residents or clients

• Friends or relatives of the people you are serving

• Post office boxes

• Personal mailboxes which can be rented to provide a permanent address

• As a last resort, people can use a post office address as General Delivery.

• A post office will hold general delivery for 30 days. People will need to contact the post office for General Delivery instructions for their area.

Again, the information from the CFPB was relevant in October 2020, but of little specific use, because the IRS has apparently discontinued the use of its “Non-Filers Tool”; the CFPB acknowledged that homeless people were eligible, and indicated that a fixed address was required to receive “mail from the IRS,” such as, presumably, a pre-loaded debit card. Homeless aid organizations were advised to suggest shelters, churches, friends and relatives, post office boxes, rented mailboxes, or as “a last resort … a post office[‘s] address as General Delivery.”

It was very clear that the amount of hurdles involved in connecting homeless and newly homeless people with much-needed EIPs was quite high. And after quite a long search, we still had no clear information for homeless people regarding third stimulus payments.

At the end of the Newsweek article, readers were directed to a March 12 2021 IRS news release titled “IRS begins delivering third round of Economic Impact Payments to Americans.” The closest thing to relevant information for homeless people is bolded below, but it was necessary to understand homeless people were included in “non-filers,” as the words “homeless,” “houseless,” or “fixed address” did not appear:

Because these payments are automatic for most eligible people, contacting either financial institutions or the IRS on payment timing will not speed up their arrival. Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits. A payment date for this group will be announced shortly.

The third round of Economic Impact Payments (EIP3) will be based on the taxpayer’s latest processed tax return from either 2020 or 2019. This includes anyone who successfully registered online at IRS.gov using the agency’s Non-Filers tool last year, or alternatively, submitted a special simplified tax return to the IRS. If the IRS has received and processed a taxpayer’s 2020 return, the agency will instead make the calculation based on that return.

In addition, the IRS will automatically send EIP3 to people who didn’t file a return but receive Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI) or Veterans Affairs benefits. This is similar to the first and second rounds of Economic Impact Payments, often referred to as EIP1 and EIP2.

For those who received EIP1 or EIP2 but don’t receive a payment via direct deposit, they will generally receive a check or, in some instances, a prepaid debit card (referred to as an “EIP Card). A payment will not be added to an existing EIP card mailed for the first or second round of stimulus payments.

A final line included a hyperlink:

For additional information, see More details about the third round of Economic Impact Payments.

We were unable to locate specific instructions for homeless people and the March 2021 “third stimulus” through any specific resource — the IRS, the CFPB, or reporting on Ahmed’s viral tweet. As a last ditch effort, we clicked the link in the final line leading to “More details about the third round of Economic Impact Payments”; that page again appeared on first glance to be a generalized announcement about the third “round” of EIPs.

Further, the first eight sections of the eleven-section page strongly suggested that third EIPs were for filers with specific incomes. A ninth section was titled “I didn’t file a 2019 or 2020 tax return and didn’t register with the IRS.gov non-filers tool last year. Am I eligible for a payment?”

It read:

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

That was the only information specific to the March 2021 “third stimulus,” and it addressed people who:

- Didn’t file a tax return in 2019;

- Didn’t file a tax return in 2020;

- Didn’t know about or use the no-longer available “non-filers” tool in 2020, and;

- Didn’t receive any money in the first and second stimulus.

According to the IRS, third stimulus payments were available to people who were non-filers, and back payments for the first and second stimulus were also available to impacted individuals. The IRS advised people who fit those criteria to claim the “Recovery Rebate Credit” on “2020 tax forms,” using IRS.gov to file a 2020 tax return in March 2021 (or through the period of disbursement).

Summary

A tweet claiming that “homeless people did not have access to the $1,400 stimulus check, and if “you are homeless, you can go to a tax return office where they will file something called EIP return … [and] put the money on a debit card after” went viral on March 15 2021. We rated that claim “True” because it is true and important, but we want to add major caveats. It took us a long time to verify the claim, and IRS.gov proved to be a Kafkaesque nightmare in determining whether it was even accurate. Much of the relevant information was tacked on to pages about Spanish-language access or hidden in documents designed for agencies, not people. Per the IRS, homeless people and others not required to file were eligible to claim the third stimulus and to receive “all three payments.” Their advice was to “file a 2020 return” (for free) and to “claim the Recovery Rebate Credit.”

- I was really upset that homeless people did not have access to the $1,400 stimulus check. I just found this out. If you are homeless, you can go to a tax return office where they will file something called EIP return. They will put the money on a debit card after. Retweet.!

- COVID-19 will cause twice as much homelessness as Great Recession, researchers say

- Economic Impact Payments

- Recovery Rebate Credit FAQ

- Use IRS Non-Filers: Enter Payment Info Here tool to get Economic Impact Payment; many low-income, homeless qualify

- "how can homeless receive stimulus checks" | Google Trends

- Non-Filers: Enter Payment Info Here Tool Is Closed

- 'Homeless,' Third Stimulus | IRS.gov

- How to Get Your $1,400 Stimulus If You Are Homeless Right Now

- Helping Consumers Claim their Economic Impact Payment

- IRS begins delivering third round of Economic Impact Payments to Americans

- More details about the third round of Economic Impact Payments