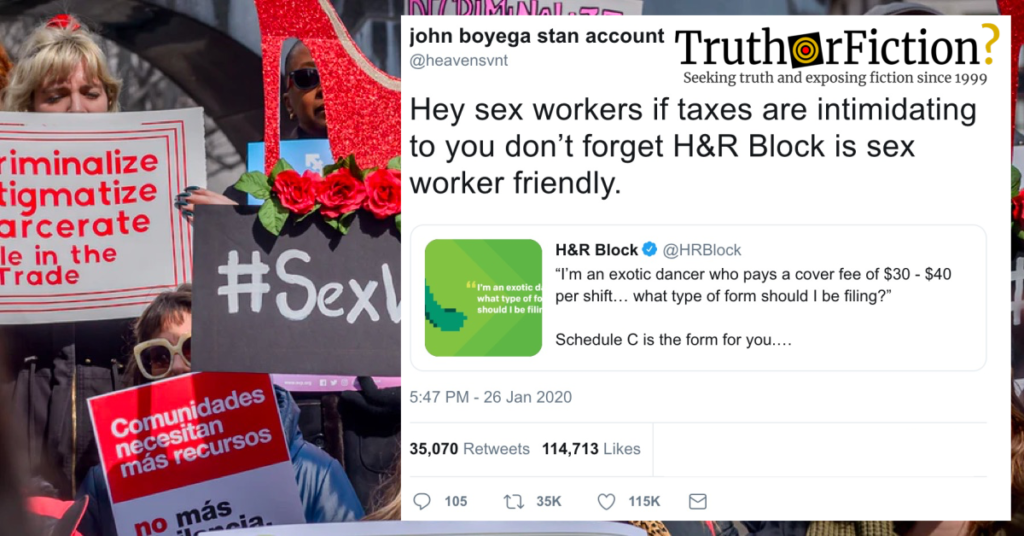

In January 2020, a post claiming that tax preparer H&R Block was “sex worker friendly” circulated — first on Twitter, then on Facebook:

In the tweet above, Twitter user @heavensvnt wrote:

Hey sex workers if taxes are intimidating to you don’t forget H&R Block is sex worker friendly.

That tweet contained a March 14 2019 tweet from @HRBlock, the brand’s verified Twitter account, which addressed the tax concerns of exotic dancers:

In that tweet, @HRBlock referenced a March 2019 Reddit AMA (which stands for “Ask Me Anything“) hosted by the brand:

“I’m an exotic dancer who pays a cover fee of $30 – $40 per shift… what type of form should I be filing?”

Schedule C is the form for you.

If you’ve ever wondered if body glitter is deductible, check out these questions from our #Reddit AMA on our blog: https://hrblock.io/AMAfreelance

Its included link was no longer functional, but the referenced page appeared to be hosted here; no link to the entire AMA in context was visible on that page. On that page, the question in its entirety was slightly more complicated, involving income derived solely from tips:

Forms to Use

Q: I’m an exotic dancer who pays a cover fee of $30-$40 per shift to work… what type of form should I be filing? My club claims I’m an independent contractor, but they haven’t paid me anything directly ever, as I make 100% of my income in cash tips from customers.A: You should probably file as a self-employed contractor. You can use a Schedule C to report your cash and tips as business income as an independent contractor. Keep track of those fees you’re paying to the club, they could be a deductible business expense too. Uniform or other props, like glitter, may be deductible.

In March 2019 through January 2020, Twitter users retweeted the original tweet as a public service announcement to a variety of sex workers, appearing to infer that all forms of sex work were covered by H&R Block services. However, sex work on a whole was a rather broad category, with legalities varying from state to state and jurisdiction to jurisdiction.

The discussion was not directly linked to (but shared some elements with) an internet controversy in 2018 known among its originators as a “thot audit,” during which some social media users attempted to harass sex workers by reporting them for suspected tax evasion — and in the process, obviously assuming that sex workers do not already report their income.

Sex workers were repeatedly advised to take their questions to H&R Block based solely on a question about one form of nominal sex work: exotic dancing. But that didn’t exactly clarify what sex workers in legally gray areas might expect from either H&R Block or the Internal Revenue Service (IRS) as it had to with income obtained by borderline or outright “illegal” means in any given jurisdiction.

We attempted to find any information provided directly by H&R Block regarding taxation on income derived from illegal activity, but only turned up information on tax evasion and related subjects. It didn’t seem to be a major surprise that H&R Block was less eager to tread into the subject of illegal income when marketing its services on social media.

That said, the IRS had no such qualms about outright adopting a stance on taxation and illegal income — and the IRS openly advised taxpaying Americans on how to abide by one set of laws regarding taxation, even while possibly breaking another set of laws.

Incidentally, the same advice provided by @HRBlock on Twitter appeared in a CNN article from 2013 about illegal income — namely, using a Schedule C form for “self-employment activity”:

As ridiculous as it sounds, the federal government requires that money acquired through illegal means be reported and taxed just like legitimate income. It’s right there on the official IRS tax instructions: “Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Form 1040, line 21, or on Schedule C or Schedule C-EZ (Form 1040) if from your self-employment activity.”

Not surprisingly, tax experts say few criminals declare their loot.

But some do, often when they’ve either been caught during that tax year or think they are about to be caught, says Stephen Moskowitz, a San Francisco tax attorney at Moskowitz LLP who has helped several clients document their illegal gains. Their goal is to avoid getting charged twice: once for their initial crime, and again for evading the taxes on their windfall. After all, it was tax charges that ultimately put away Al Capone.

[…]

Documenting illegal income is tricky, Moskowitz says.

The IRS doesn’t require any details on the return beyond an approximation of how much you made. The hard part comes if you get audited. There’s usually no paper trail, so IRS agents will typically ask for the names and contact information for people that may have been part of the illegal transaction, Moskowitz says. The agency will then try to verify your numbers with them.

It might seem foolish or risky to alert the IRS to income from activities in legally gray areas. But that same article noted that the IRS was legally prohibited from snitching to law enforcement when suspect income is reported, unless ordered by a court to do so:

If you tell the IRS you made $1 million from stealing money or dealing drugs, does the agency tip off the cops?

Legally, it can’t, unless a law-enforcement agency gets a court order granting it access to a specific taxpayer’s return. The IRS isn’t supposed to proactively alert other agencies about misdeeds unless terrorism is involved. In that case, it still needs a court order to disclose anything, but the IRS can initiate the legal process on its own.

The rules are all spelled out in an IRS guide to “section 6103,” the law that covers tax-return confidentiality. Like many legal statutes, it’s complex and filled with loopholes. For example, the IRS might not be allowed to share the contents of actual tax returns on its own initiative, but it can divulge supplemental information obtained from outside sources — like witnesses interviewed in an audit investigation — “to apprise federal criminal law enforcement agencies of possible crimes,” according to the agency’s guide.

That said, tax experts were divided on whether the IRS reported suspect income to law enforcement as a matter of course, with at least two experts claiming that the agency “absolutely” tips off police and federal agents to possibly illicit transactions. Although guidance was derived from official IRS directives to taxpayers, the agency declined to comment on the specifics.

In that same article, a representative of H&R Block’s Tax Institute provided highly relevant information regarding possibly illegally obtained income, tax preparers, and the IRS. That individual confirmed that tax preparers do not have attorney-client privilege, and that they are obligated to provide additional information to the IRS or law enforcement:

“If there’s anything we suspect is criminal, the first thing we do is tell people to get legal advice,” says Gil Charney, principal tax researcher at H&R Block’s (HRB) Tax Institute. “We don’t have attorney-client privilege. If The IRS or any law enforcement agency contacts us, we have to provide that information.”

In the IRS’ Publication 17, updated in 2018, guidance to putative taxpayers addresses “Illegal activities” among a long list of income sources. As an example, the IRS used “dealing illegal drugs” as legally taxable income under that section:

Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 21, or on Schedule C (Form 1040) or Schedule C-EZ (Form 1040) if from your self-employment activity.

Once again, Schedule C (Form 1040) was cited as the proper form to document “self-employment activity,” regardless of its legality. In that sense, H&R Block’s Twitter advice was broadly appropriate for sex workers of all types, legality notwithstanding.

A March 2019 tweet by H&R Block/@hrblock specifically dealing with an exotic dancer paid solely in tips was held up as evidence that the firm was “sex worker friendly,” a claim which was met with enthusiasm but contained possible major pitfalls. As Charney said in the 2013 CNN piece, H&R Block and other tax preparers do not have attorney-client privilege, and are not likely equipped to handle specific queries about income which may have been obtained by extralegal or illegal methods. We rated this claim decontextualized, since @hrblock was clearly open to working with some sex workers — but we wanted to make certain that we added a caveat about Schedule C/Form 1040 for income which might not be fully legal in any given individual’s jurisdiction.