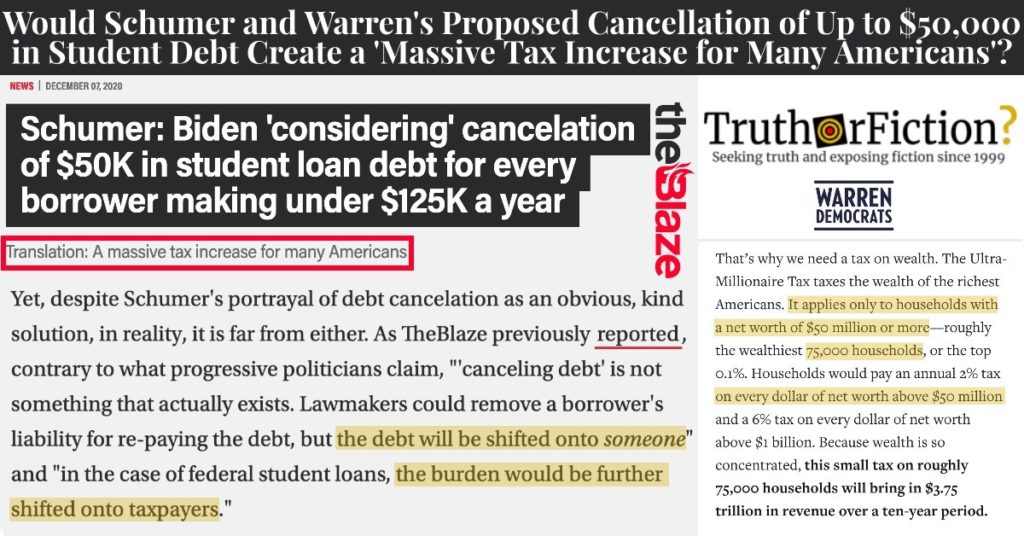

On December 8 2020, The Blaze published an article headlined, “Schumer: Biden ‘considering’ cancelation of $50K in student loan debt for every borrower making under $125K a year,” with the subheading, “Translation: A massive tax increase for many Americans” and beginning with:

Senate Minority Leader Chuck Schumer (D-N.Y.) said [on December 7 2020] that former Vice President Joe Biden is “considering” forgiving $50,000 in federal student loan debt for every borrower with an annual salary of under $125,000 — a move that would place an incredibly heavy burden on taxpayers.

More than 40 million Americans currently have outstanding federal loans, amounting to a whopping total of $1.54 trillion in debt.

What did [Schumer] say?

“We have come to the conclusion that President Biden can undo this debt, can forgive $50,000 of debt the first day he becomes president,” Schumer announced to supporters outside of his New York office. “You don’t need Congress; all you need is the flick of a pen.“I have told him how important it is. He is considering it,” Schumer added …

The Blaze did not describe how the plan was necessarily an “incredibly heavy burden on taxpayers,” despite the headline, subheadline, and opening paragraphs, but the piece concluded with:

As TheBlaze previously reported, contrary to what progressive politicians claim, “‘canceling debt’ is not something that actually exists. Lawmakers could remove a borrower’s liability for re-paying the debt, but the debt will be shifted onto someone” and “in the case of federal student loans, the burden would be further shifted onto taxpayers.”

“Previously reported” backlinked to a November 18 2020 article by The Blaze, “Joe Biden supports ‘immediately’ canceling some student loan debt, penalizing American taxpayers.” Wording in the excerpt appeared almost verbatim in the earlier item, which was also extremely light on details.

That short article quoted “one critic” (unnamed), who purportedly said Americans without student debt would be penalized, but not in the form of a tax increase:

Contrary to what progressives like Ocasio-Cortez claim, “canceling debt” is not something that actually exists. Lawmakers could remove a borrower’s liability for re-paying the debt, but the debt will be shifted onto someone.

In the case of federal student loans, the burden would be further shifted onto taxpayers.

Canceling student loan debt, then, rewards Americans who choose to go into debt for a degree — and agree to re-pay their debt — while penalizing Americans who did not choose debt, one critic told Ocasio-Cortez. Magically wiping away debt absolves all responsibility for mostly unwise decisions, removing the life-learning element included in accepting a mountain of debt for a college degree with a poor return on investment.

Again, both pieces were extremely light on detail and primarily relied on random tweets as citations. For instance, the “one critic” was apparently The Blaze’s social media editor Jessica O’Donnell, whose exact words were:

O’Donnell proffered an opinion about the burden of student debt, musing possibly that the plan was simply unfair to anyone who had already paid off their student debt. Although the tweet said that canceled student debt was “moving” it to people “who already paid for [their] student loans,” no mechanism by which that might happen was described or referenced.

Another citation in the earlier article appeared when text indicated Democrats “scaled back” earlier 2020 plans to cancel some student debt when the “Congressional Budget Office estimated that it would cost between $200 billion and $300 billion to forgive the amount of debt they were proposing.” That too linked not to policy documents, but rather a tweet:

We were unable to access that content; it was possible the citation was in tweet format because the author also was unable to access it behind a paywall. Reference to the same figure The Blaze cited appeared in other reporting, all of which cited the above tweet.

No one appeared to have access to anything except Stratford’s tweet — which had to do with one specific provision of one specific emergency bill in May 2020. Stratford also linked to amendments to that May 2020 bill (HR 6800, PDF), but it did not contain any information about the cost of the originally proposed student debt relief, and it did not specify any number of billions. (The term “forgiveness” appeared four times, three of which had nothing to do with student loans.)

Before and immediately after the November 3 2020 election, Sens. Chuck Schumer and Elizabeth Warren, among others, renewed calls for President-Elect Joe Biden to forgive up to $50,000 in debt, and many more news organizations covered those appeals. A December 3 2020 Yahoo article appeared at first to address the cost of up to $50,000 in debt forgiveness and cited a price tag ($1 trillion), but once again pivoted to disparity for people without debt rather than enumerating what the actual fiscal burden placed upon them might be:

Cancel $50,000

To truly fix the system, according to [Louise Seamster, a student loan researcher and assistant professor at the University of Iowa], the cancellation of loans would have to be at least $50,000.Democratic Senators Elizabeth Warren (D-MA) and Chuck Schumer (D-NY) both called for forgiveness on $50,000 of federally-backed student debt across the board, which would erase the total balances of 80% of borrowers and nearly 70% of the government’s student debt portfolio.

The cost of forgiving $50,000 across the board would be at least a trillion dollars. One major drawback, some experts argue, is that many borrowers holding high levels of debt are those with advanced degrees who are not low-income. That cohort is less in need of student debt forgiveness.

On December 2 2020, The Conversation examined the renewed calls for student debt cancellation, in part citing the same reasons in a broader look at the morality behind student debt cancellation:

Canceling debt also seems to violate the moral principle of following through on one’s promises. Borrowers have a moral duty to fulfill their loan agreements, the philosopher Immanuel Kant argued, because reneging on promises is disrespectful to oneself and others. Once people have promised to do something, he noted, others rely upon that promise and expect them to follow through.

In the case of federal student loans, a borrower signs a promissory note agreeing to pay back the government and, ultimately, the taxpayers. And so student borrowers seem to have a moral duty to pay their debts unless mitigating circumstances like injury or illness arise.

On December 4 2020, Warren penned an op-ed about the proposal she and Schumer promoted; Schumer tweeted about it on December 7 2020:

Time and again, article headlines mentioned “risks” and tax burdens, going on to argue that the plan was a “moral” hazard. “Risk” appeared in the headline, but not in the body — which concluded:

There also will be general political backlash on moral hazard grounds from those who see folly in rewarding students for racking up huge debts they couldn’t afford to colleges that took advantage of government largesse to jack up costs.

Government has “allowed universities to go on this crazy trajectory of increasing their costs without any additional benefit to students,” said Carol Roth, head of Intercap Merchant Partners.

“Colleges bear a lot of the responsibility, and they have basically been taking the dollars facilitated by government in a predatory way,” she added.

While Roth acknowledges the larger economic issues, she said it’s wrong that taxpayers have to pick up the tab for some borrowers and not others.

“We have to move away from governments picking winners and losers,” she said. “The government shouldn’t be doing that, and it’s not fair to have people who decided not to go to college, whether it’s directly or indirectly, bearing the burden for the situation they had no role in causing.”

A mid-November 2020 InsideHigherEd.com report on calls for Biden to bypass Congress noted Republicans opposed plans to cancel student debt. This time, the reason cited was not any potential tax burden:

Congressional Republicans have opposed student debt cancellation this year [2020] during negotiations of coronavirus relief packages, believing it is unfair to people who didn’t go to college. The letter also noted that Warren and Senate Minority Leader Chuck Schumer in September called on the next president to cancel $50,000 in federal student debt from all borrowers through an executive order, a move that would completely eliminate the balances of 75 percent of all borrowers.

In all of the articles we looked into for our research, unspecific costs were mentioned in passing, with far more focus placed on whether cancellation of $50,000 of student debt was “fair” to people who either had already paid off their loans or who didn’t go to college at all. Given that Warren’s original proposal of the $50,000 figure and her involvement with Schumer’s December 2020 calls for Biden to enact such a plan, the likeliest answer to who would pay for student debt cancellation could be found there.

On ElizabethWarren.com, a page about cancelling student debt explained Warren’s plan to pay for the proposal:

Some people will say we can’t afford this plan. That’s nonsense. The entire cost of my broad debt cancellation plan and universal free college is more than covered by my Ultra-Millionaire Tax — a 2% annual tax on the 75,000 families with $50 million or more in wealth. For decades, we’ve allowed the wealthy to pay less while burying tens of millions of working Americans in education debt. It’s time to make different choices.

Warren added:

Canceled debt will not be taxed as income.

TheBlaze.com’s December 2020 piece described the proposal as “a massive tax increase for many Americans,” but Warren indicated that only 75,000 families who had accumulated “more than $50 million in wealth” would see a tax increase — which was described on a second page:

The Ultra-Millionaire Tax taxes the wealth of the richest Americans. It applies only to households with a net worth of $50 million or more—roughly the wealthiest 75,000 households, or the top 0.1%. Households would pay an annual 2% tax on every dollar of net worth above $50 million and a 6% tax on every dollar of net worth above $1 billion. Because wealth is so concentrated, this small tax on roughly 75,000 households will bring in $3.75 trillion in revenue over a ten-year period.

Warren’s proposal applied to 75,000 households and amounted to a two percent tax “on every dollar of net worth over $50 million,” meaning that the first $50 million in net worth would not be taxed further. Net worths of more than $1 billion would be taxed at 6 percent (and the concentration of wealth in the United States is such that this plan would pay for student debt cancellation and other plans.)

Circling back, articles also often mentioned that debt cancellation would be taxed as income, but a September 2020 joint release from Schumer and Warren specifically stated otherwise:

Senate Democratic Leader Chuck Schumer (D-NY), Senator Elizabeth Warren (D-MA.), Member of the Senate Health, Education, Labor, and Pensions (HELP) Committee and their colleagues introduced a resolution [in September 2020] outlining a bold plan for the next President of the United States to use existing authority under the Higher Education Act to cancel up to $50,000 in Federal student loan debt for Federal student loan borrowers. The resolution outlines how the President should use executive authority to cancel student loan debt and ensure there is no tax liability for Federal student loan borrowers resulting from administrative debt cancellation.

A December 7 2020 article on right-wing site The Blaze addressed Warren and Schumer’s calls for President-Elect Joe Biden to cancel up to $50,000 of student debt with executive action, bypassing Congress; the site falsely claimed it would create a “massive tax increase for many Americans,” while other organizations baselessly warned that the plan was “a moral hazard” or “a tax liability” for those whose debts would be canceled. Warren has long proposed canceling student debt and a tax increase, but not on “many Americans.” Not only does Warren’s tax plan only potentially affect 75,000 households (in a country with about 120 million households as of 2018), it only applied to net worth over $50 million.

- Schumer: Biden 'considering' cancelation of $50K in student loan debt for every borrower making under $125K a year

- Joe Biden supports 'immediately' canceling some student loan debt, penalizing American taxpayers

- You’re not “canceling” a debt. You’re moving it. Someone has to pay. And it’s going to be the people who already paid for our student loans because we worked hard and said “no” to a lot of fun things the folks with debt chose to say “yes” to.

- House Democrats are significantly scaling back the student loan forgiveness provisions in their $3T coronavirus relief package, citing concerns about the cost:

- House Democrats scale back $10,000 student-loan-forgiveness measure in their coronavirus spending package because it would cost too much

- AMENDMENT TO H.R. 6800 OFFERED BY MRS. LOWEY OF NEW YORK

- Here's what student debt forgiveness would look like for borrowers and the U.S. government

- The morality of canceling student debtin part

- Why We, Elizabeth Warren And Chuck Schumer, Believe The Biden-Harris Administration Should Cancel Up To $50K In Student Debt On Day One

- President-elect Joe Biden can #CancelStudentDebt on Day 1. This is the single most effective executive action available to provide massive stimulus to our economy.

- Biden’s plan to forgive student debt could have limited economic benefits, and carry risks

- Groups Call on Biden to Cancel Student Debt

- Groups Call on Biden to Cancel Student Debt

- Affordable Higher Education for All

- Ultra-Millionaire Tax

- Schumer, Warren: The Next President Can and Should Cancel Up To $50,000 In Student Loan Debt Immediately; Democrats Outline Plan for Immediate Action in 2021