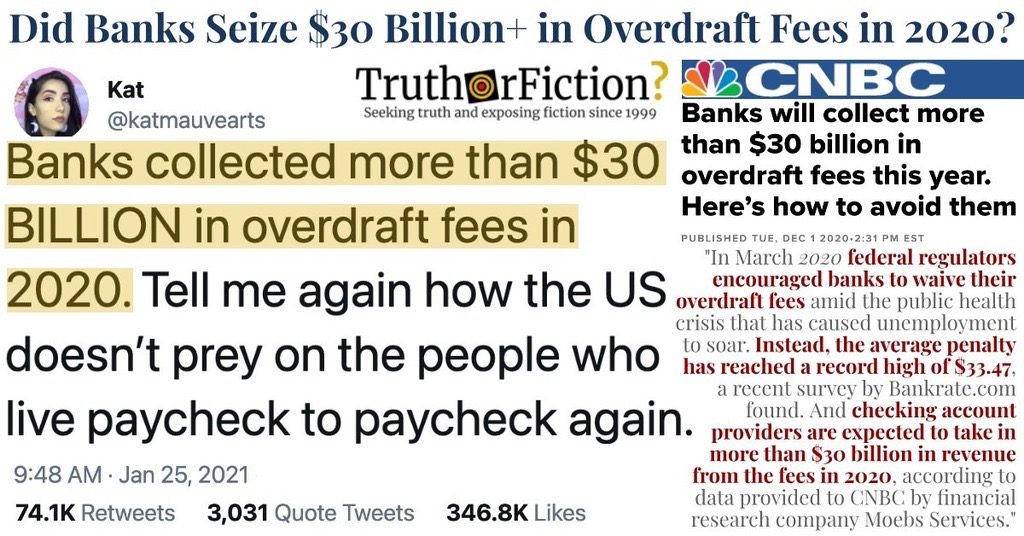

On March 11 2021, the Facebook page “Memes to Radicalize Your Friends” shared an undated screenshot of a tweet by @katmauvearts, which contained the claim that banks collected had collected a total of $30 billion in overdraft fees from Americans in 2020 — a year during which employment and wages were often disrupted by the COVID-19 pandemic:

Posted by Memes to Radicalize Your Friends on Thursday, March 11, 2021

Original Claim and Prior Iterations

The screenshot showed a January 25 2021 tweet from @katmauvearts:

Initially, the statement sounded familiar; in January 2019, we examined a nearly identical claim about banks collecting $30 billion in overdraft fees, but in 2018:

Overdraft Fees in 2019 Versus the Events of 2020

We rated the January 2019 fact check above as “decontextualized,” due to the fact that versions of the meme had been in circulation since 2012, and was thus based on old data. In the years between that page’s publication and the new variation in January 2020, a New York Times article (“Banks Took $11 Billion in Overdraft Fees in 2019, Group Says”) suggested that profits on overdrafts had dropped in relation to 2012 figures.

The June 3 2020 article included details about the mid-2020 financial landscape, and the high rates of unemployment at that time:

Large U.S. banks took $11.68 billion in overdraft fees out of their customers’ accounts last year [2019], even before the pandemic kicked off an economic crisis, according to research by the Center for Responsible Lending.

Vulnerable people were by far the hardest hit: Nine percent of account holders paid 84 percent of the overdraft fees, according to the review, which focused on banks with assets of more than $1 billion. Those customers tended to carry low balances, averaging less than $350.

The organization said banks should halt overdraft fees during the pandemic, which has led to 40 million new unemployment claims and significant uncertainty about how any recovery will play out.

Two days later on June 5 2020, CNBC published a similar piece (“Overdrafts earned the biggest banks $11.68 billion last year—and experts warn they could ‘balloon exponentially’ during the pandemic”), citing the $11.68 billion figure from 2019 and predicting higher overdraft profits for 2020:

Roughly 2 out of 3 Americans who have lost jobs or had their paychecks reduced as a result of [events in 2020] are worried about their ability to pay their bills, according to the latest TransUnion Consumer Financial Hardship Study. While about 60% of those surveyed are cutting back on their spending in an effort to stretch their budgets, many may wind up overdrawing their accounts and paying overdraft fees.

Banks typically charge overdraft fees when you overdraw your checking account … These fees add up. Last year [2019], banks with assets of $1 billion or more charged customers $11.68 billion in overdraft and non-sufficient fund fees, according to a recent report from the Center for Responsible Lending. The total does not include credit unions or smaller institutions with under $1 billion in assets.

The number of overdraft fees could “balloon exponentially” as a result of the [ongoing] crisis, the report finds. The high levels of under- and unemployment Americans currently [in June 2020] face — the Labor Department’s latest total shows 42 million people are unemployed — could cause financial strain and potentially lead to unprecedented volumes of overdrafts.

CNBC noted that the standard overdraft fee was typically between $30 and $35, but that struggling Americans could be hit with the same fee up to 12 times in a single day should their account become overdrawn — and the practice of “reordering transactions” to maximize fees could exacerbate the problem for anyone facing financial strain:

A $30 to $35 overdraft may not seem like a lot, but these fees can compound quickly for consumers. Big banks tend to cap the number of overdraft fees at four to six per day, but some allow up to 12 per day, according to ValuePenguin’s analysis of policies at the 16 largest U.S. consumer banks. That means you could easily end up with fees that range from $120 to $420 if you’ve overdrafted multiple times … Many times, customers overdraft despite carefully attempting to avoid it because some banks will reorder how the purchases are transacted, posting larger expenses first so the account is depleted more quickly, CRL’s report says.

According to the Center for Responsible Lending, banks clocked closer to $12 billion in overdraft fees in 2019 — a large number, but a far cry from the first $30 billion figure we examined in early 2019. But @katmauvearts’ tweet suggested that in 2020, banks and financial institutions vacuumed up an additional $18 billion in overdraft fees over 2019.

Did Banks Collect More Than $30 Billion in Overdraft Fees in 2020?

The New York Times and CNBC both reported on the Center for Responsible Lending’s 2019 overdraft figures in June 2020; we were unable to find any 2020 figures from that organization as of March 15 2021 (it is likely that the data will not be available until mid-2021).

However, on December 1 2020, CNBC published, “Banks will collect more than $30 billion in overdraft fees this year. Here’s how to avoid them.” That article began with a statement from a furloughed worker who lost $70 in overdraft fees after losing their paycheck due to the pandemic, and it continued:

In March [2020], federal regulators encouraged banks to waive their overdraft fees amid the public health crisis that has caused unemployment to soar. Instead, the average penalty has reached a record high of $33.47, a recent survey by Bankrate.com found. And checking account providers are expected to take in more than $30 billion in revenue from the fees in 2020, according to data provided to CNBC by financial research company Moebs Services.

[…]Yet, while many banks came out early in the pandemic with policies to help customers, including waiving overdraft fees, many of those relief measures have now [as of December 2020] ended, according to Ken Tumin, founder and editor of DepositAccounts.com.

“With job losses that are still high, the finances of many households are still under pressure,” Tumin said. “That has resulted in more consumers being hit with overdraft fees.”

Banks will generally charge you an overdraft fee when you make a purchase or get dinged with a scheduled bill that exceeds the money you have in your checking account at the time. Even before the pandemic, each year, about a third of checking accounts, or around 120 million, went into the negative at some point, Moebs Services found.

That excerpt described one common cause of overdraft fees — when an abrupt loss of some (or all) income reduces spending, but automatic bill pay functions override a depleted account and drive its balance into the negative. From there, a bank account holder might at first be unaware, making several small purchases that would then generate still more fees.

CNBC reiterated how prominent automatic bill pay settings were in recurring overdrafts:

You can decide not to enroll in [your bank’s] “overdraft protection” program, or, if you knowingly or unknowingly signed up previously, you can ask to opt out at any time, said Peter Smith, a senior researcher at the Center for Responsible Lending.

That way, your debit card will just be declined when you try to make a purchase with an account that doesn’t have enough money in it. However, keep in mind: Most banks will still charge you overdraft fees on recurring bills.

Consequently, even consumers with low bank balances who elect not to participate in the bank’s “overdraft protection program” — enabling transactions to go through despite insufficient funds for $30 to $35 per transaction — could still be hit with cascading $30 or $35 overdraft fees if a “recurring bill” is paid automatically. And because of the previously described practice by some banks of “reordering transactions,” the largest transaction could be “ordered” before purchases made with a positive bank balance, causing the consumer to be charged $35 for multiple transactions made when money was in their account with overdraft protection disabled.

CNBC’s June 2020 article about 2020 overdraft fees provided relevant information concerning policies at primary banking institutions in the United States — many of which as of May 2020 had not suspended overdraft fees, despite extraordinarily high joblessness rates at that point:

As of mid-May [2020], none of the 10 largest banks — Bank of America, JPMorgan Chase, Wells Fargo, Citibank, U.S. Bank, Truist (formerly BB&T and SunTrust banks), PNC Bank, Capital One, TD Bank and HSBC — had offered any sustained relief from overdraft fees during the crisis, CRL’s report found. These banks cap the number of overdraft fees per day at between three and six and all except Citi will waive overdraft fees if the overage is less than $5 (HSBC allows up to $10 overdrawn without charging overdraft fees), according to the CRL report.

Summary

A viral tweet and subsequent posts claimed that banks collected $30 billion in overdraft fees from Americans in 2020, up more than $18 billion from official figures calculated annually by the Center for Responsible Lending and most recently updated in June 2020. In January 2019, we examined a similar claim involving the same amount ($30 billion), finding that that figure dated back several years and had since dropped. In 2019, banks collected $11.68 billion in overdraft fees. A December 2020 CNBC report included an estimate of overdraft fees for that year calculated by economic research and consulting firm Moebs Services. Although we have currently rated the claim Unknown due to anticipated final figures in June 2021, @katmauvearts’ figure of $30 billion was rooted in a credible source — the December 1 2020 CNBC article aggregating data and estimating the effects of 2020’s multiple crises, and how they translated to overdraft fees.

- Banks collected more than $30 BILLION in overdraft fees in 2020. Tell me again how the US doesn’t prey on the people who live paycheck to paycheck again.

- Banks collected more than $30 BILLION in overdraft fees in 2020. Tell me again how the US doesn’t prey on the people who live paycheck to paycheck again.

- Did Banks Collect $30 Billion in Overdraft Fees in 2018?

- Banks Took $11 Billion in Overdraft Fees in 2019, Group Says

- Overdrafts earned the biggest banks $11.68 billion last year—and experts warn they could ‘balloon exponentially’ during the pandemic

- New Overdraft Report Urges Congress, Regulators, Banks to Halt Burdensome Bank Fees That Threaten Economic Recovery

- Banks will collect more than $30 billion in overdraft fees this year. Here’s how to avoid them