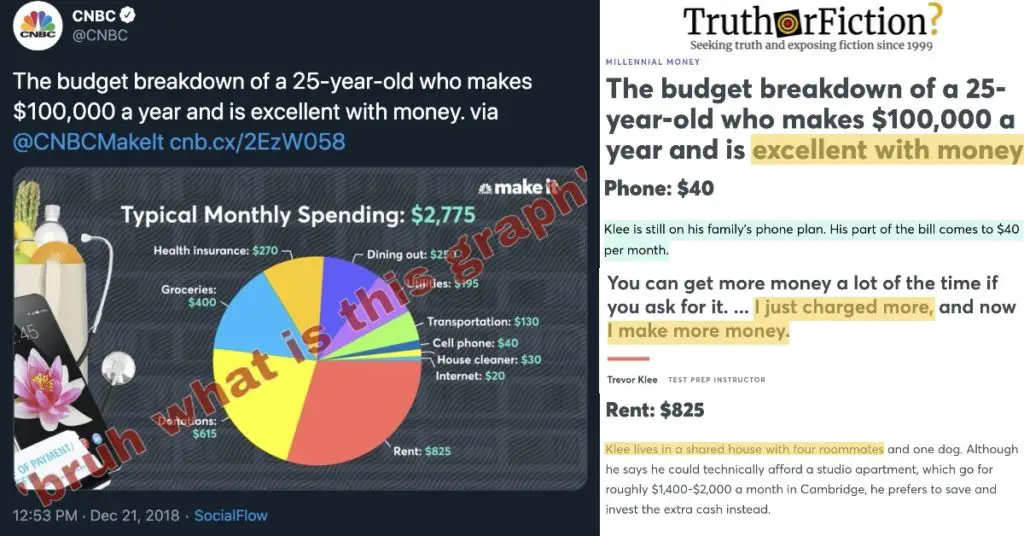

As COVID-19 related economic woes dragged on in August 2020, a Facebook user shared a CNBC “budget breakdown” chart — which involved a 25-year-old man earning $100,000 a year:

On August 14 2020, the user shared the above chart with a very short status update: “bruh what is this graph.” In just a few days, the post was shared nearly 20,000 times.

CNBC’s Original Tweet, and Common Responses

Although the post appeared on Facebook in August 2020, it in fact showed a CNBC tweet from December 2018:

Twitter users commented on the 2018 tweet after the Facebook screenshot went viral in 2020, typically observing the ease with which one could manage money while earning six figures, or questioning the expenses described on the graph:

Similar responses appeared after CNBC first shared the graph:

Readers observed that the income seemed atypically high, and the balance of figures for expenses — such as housing, house cleaning, cell phone, internet, and rent — were suspiciously low to the point they were likely offset by generous parents.

The Article

On December 21 2018, CNBC published an article (linked in the tweet), filed under “Millennial Money” and titled “The budget breakdown of a 25-year-old who makes $100,000 a year and is excellent with money.” It began with an introduction to subject Trevor Klee, and his acknowledgement “luck and privilege” were a major element of his being “excellent with money.”

As for the “job” in which Klee earned six figures at the age of 25, CNBC explained that he tutored people for standardized tests in Cambridge, Massachusetts:

Trevor Klee, he admits, is a “terrible employee.”

But he’s great at working for himself — and at taking tests. So the 25-year-old entrepreneur started a thriving business of his own. As a test prep instructor in Cambridge, Massachusetts, he brings in $100,000 a year tutoring people for the GMAT, GRE and LSAT. “It’s one of those weird skills that turned out to be really monetizable,” he tells CNBC Make It.

Klee is the first to acknowledge he’s benefited from both luck and privilege: “Growing up in a family that talked a lot about money was a definite advantage,” he says. “In a lot of ways, I feel like I’m good with money, but I’m playing life on ‘Easy’ mode: I’m a single guy with no dependents and I make a pretty solid income.”

As many users suspected, Klee’s $825 rent payment was the result of having a large number of roommates:

Klee lives in a shared house with four roommates and one dog. Although he says he could technically afford a studio apartment, which go for roughly $1,400-$2,000 a month in Cambridge, he prefers to save and invest the extra cash instead.

Presumably, his relatively low expenses for house cleaning, internet, and utilities were due to his sharing a residence with four other adults. As for the $40 cell phone plan:

Klee is still on his family’s phone plan. His part of the bill comes to $40 per month.

The Consensus

Whether CNBC sought to drive traffic to the page with the story of “The budget breakdown of a 25-year-old who makes $100,000 a year and is excellent with money,” widespread speculation that Klee’s budget was highly atypical and padded by parental help were accurate. Commenters pointed out that a combination of high income relative to age as well as help from family or roommates made it far easier to be “excellent with money,” and those factors were explained in the article. Klee’s $825 rent and $20 internet, for instance, were figures likely divided by five — assuming all roommates paid the same share, the actual rent on his home would be more than $4,000. Although the chart was aggravating enough to go viral at least twice, its conditions and Klee’s financial life were anything but representative of his peers.